Delving into the Financial Labyrinth

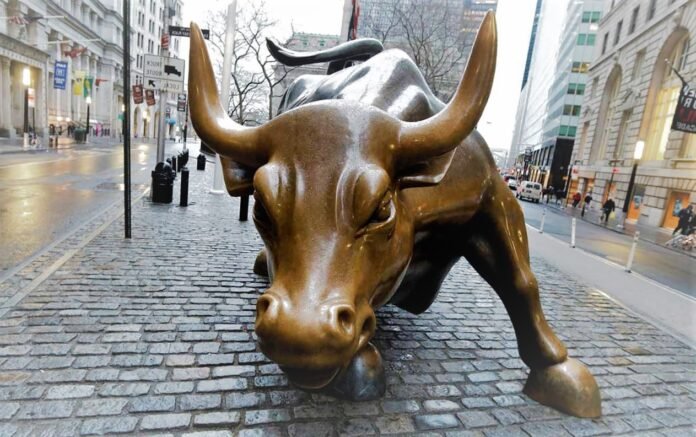

On an unassuming street in lower Manhattan, New York City, Wall Street pulses with the heartbeat of the world’s financial markets. Here, “Wall Street” transcends its physical boundaries, embodying the spirit of American finance and investment. So, what lies beneath the surface of this enigmatic titan? Join us on a whirlwind exploration of Wall Street’s storied past and intricate inner workings.

A Tapestry of Time: Wall Street’s Genesis

Journey back to the 18th century, when the Buttonwood Agreement ignited Wall Street’s transformation. Under a stately buttonwood tree, twenty-four brokers and merchants forged a pact in 1792, crafting a rudimentary system for trading company shares. This pivotal moment birthed the New York Stock Exchange (NYSE), which has blossomed into the colossal trading platform we know today.

The Stock Exchange: A Dance of Buyers and Sellers

At its essence, the NYSE orchestrates an intricate ballet, uniting buyers and sellers in a centralized marketplace. Trading shares of public companies becomes a harmonious affair, with transactions conducted securely and expeditiously. The stock exchange champions the auction model, with buyers vying for shares while sellers court their offers at specific prices. In this dance, supply and demand dictate the tempo, and the stock exchange emerges as a masterful conductor.

Brokers and Market Makers: The Choreographers of Commerce

Brokers and market makers are indispensable virtuosos in Wall Street’s grand production. Licensed brokers skillfully navigate the divide between investors and the stock exchange, ensuring the seamless execution of buy and sell orders.

Market makers, contrarily, are maestros of market liquidity. By simultaneously quoting buy and sell prices for a given stock, they sculpt the market landscape for that security. Their artistry guarantees a continuous supply of buyers and sellers, smoothing out price fluctuations and fostering fluid trading.

The Tides of Fortune: A Roller Coaster of Market Fluctuations

Wall Street has weathered tumultuous storms and ridden waves of prosperity. Notable events include:

- The Great Depression (1929-1939): A catastrophic maelstrom, beginning with the stock market crash of 1929 and culminating in a worldwide economic downturn. Speculative trading, margin buying, and an inflated market brewed the perfect storm, leaving a legacy of unemployment, poverty, and lasting regulatory reforms.

- Black Monday (1987): October 19, 1987, bore witness to the steepest single-day decline in stock market history. The Dow Jones Industrial Average plunged 22.6%, sending tremors throughout the financial world. The enigmatic catalyst for Black Monday remains elusive, though program trading, illiquidity, and market psychology are prime suspects.

- The Dot-com Bubble (1995-2000): The internet’s meteoric rise in the late 1990s spawned a technology stock frenzy. Investors clamored for a piece of the action, inflating a precarious bubble that burst in 2000, triggering a market correction and the downfall of overvalued tech companies.

- The Global Financial Crisis (2008): Precipitated by the collapse of the US housing market and risky lending practices, the 2008 crisis marked the nadir of economic downturns since the Great Depression. With financial giants like Lehman Brothers toppling, governments scrambled to implement unprecedented fiscal and monetary measures. The fallout? A fresh wave of financial regulations to thwart future catastrophes.

The Digital Revolution: The Emergence of High-Frequency Trading

Wall Street’s landscape has been irrevocably altered by a tidal wave of technological innovation. Electronic trading platforms and algorithmic strategies have paved the way for high-frequency trading (HFT) to take center stage. HFT firms harness the power of cutting-edge computers and sophisticated algorithms, orchestrating massive trade volumes at breakneck speeds. Capitalizing on minuscule price disparities, they accumulate profits at a staggering rate.

Though HFT has garnered praise for streamlining market efficiency and reducing trading costs, detractors warn of potential pitfalls. Heightened market volatility and systemic risks lurk in the shadows, threatening to destabilize the delicate balance.

Wall Street in the Modern Age: A Kaleidoscope of Finance

Today, Wall Street is a dazzling tapestry of financial entities and institutions, extending far beyond the stock exchange. Investment banks, hedge funds, and private equity firms intermingle, shaping the global economy’s very fabric. Their influence enables businesses to tap into capital, manage risks, and propel economic growth.

Throughout its history, Wall Street has demonstrated a remarkable ability to adapt and persevere in the face of adversity. As technology and market dynamics continue to evolve, Wall Street stands poised at the vanguard of global finance, orchestrating the symphony of wealth creation and investment opportunities for generations to come.

Google News | Telegram