Global Economic Markets

The complexity of global economic markets is marked by the elusive nature of its growth cycles. It is therefore paramount to have an intimate comprehension of the interplay between perplexity and burstiness in order to ascertain the factors responsible for the oscillatory nature of these markets. In this article, we will undertake a detailed analysis of the intricate phases of growth that are inherent in the global economic markets and also the multifaceted factors that engender these cycles.

Phase 1: The Expansion Phase

The expansion phase is the foremost stage in the market cycle. It is marked by an upward trajectory in economic activity, as businesses grow and the economy expands. This phase is characterized by robust economic indicators such as a surge in GDP, minimal unemployment rates, and escalating consumer spending. As the economy burgeons, businesses invest in novel equipment, enlarge their workforce, and also expand their operations.

Phase 2: The Peak Phase

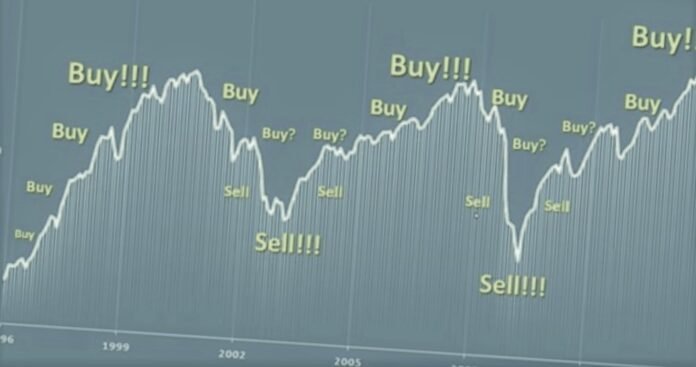

The peak phase is the second stage of the market cycle. It is during this phase that the economic growth starts to decelerate as the market reaches its apogee. Economic indicators begin to manifest signs of stagnation such as a plateauing of the GDP or an increase in the rate of unemployment. This phase also instills a sense of apprehension in investors who tend to liquidate their assets in anticipation of an impending downturn in the market.

Phase 3: The Contraction Phase

The contraction phase is the third stage of the market cycle. It is typified by a decline in economic activity, resulting in a contraction of businesses. Economic indicators such as GDP and employment rates begin to plummet, and investors become more risk-averse, leading to a higher rate of asset liquidation. This exacerbates the contraction and drives down prices.

Phase 4: The Trough Phase

The trough phase is the final stage of the market cycle. It is characterized by a stabilization of the economy after it has hit rock bottom. Economic indicators start to manifest signs of improvement, such as a gradual increase in GDP or a plateauing of unemployment rates. This is the time when investors perceive value in the market and may start to buy back assets at a lower price, initiating the next expansion phase.

Factors that Drive Market Cycles

The factors that engender the cycles of growth in global economic markets are multifarious. Some of the most prominent include:

Economic Policy: Government policies can have a momentous impact on market cycles. For example, a government that implements policies designed to stimulate economic growth, such as tax cuts or increased spending on infrastructure projects, may be able to prolong the expansion phase of a market cycle.

Business Cycles: Several businesses operate on their own cycles of growth and contraction. When multiple businesses in a particular industry are expanding, it can create a ripple effect that drives overall economic growth. Conversely, when many businesses in an industry are contracting, it can lead to an economic downturn.

International Trade: The fluctuations in global demand for certain products or services can have a momentous impact on market cycles, particularly in export-dependent economies. Changes in international trade can lead to shifts in economic activity that can drive market cycles.

Conclusion

In conclusion, comprehending the cycles of growth in global economic markets is crucial for businesses and individuals alike. By recognizing the different phases of these cycles and the factors that engender them, investors and entrepreneurs can make more informed decisions about when to invest or expand their operations. Although market cycles are difficult to predict, having an intricate understanding of the underlying factors that engender them can help to mitigate risks and maximize returns.

Google News | Telegram