The Art of Stock Market Timing: A Daunting Endeavor

Embarking on the stock market journey can be quite lucrative for those endowed with perseverance, meticulousness, and unwavering self-control. Nevertheless, pinpointing the precise moment to seize ownership of company shares is of paramount importance. This article delves into an array of factors and tactics instrumental in ascertaining the most opportune juncture for share acquisition, encompassing market climate, corporate prowess, and macroeconomic gauges.

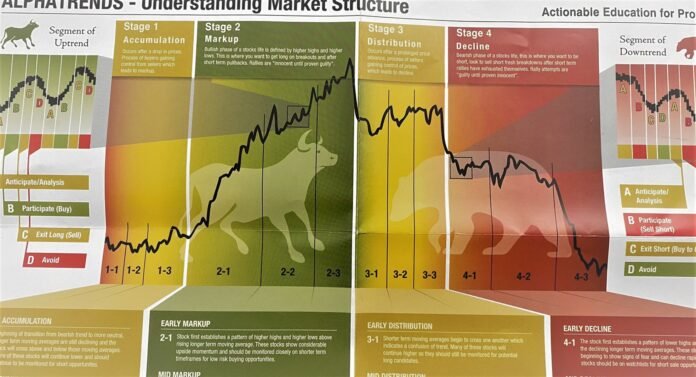

Dissecting the Intricacies of Market Cycles

The Dance of Bulls and Bears

The ebb and flow of market cycles wield a profound impact on the prime occasion to procure shares. Ascending stock prices, burgeoning investor assurance, and an overall buoyant market sentiment epitomize a bull market. In stark contrast, plummeting stock prices, prevailing pessimism, and dwindling investor confidence characterize a bear market. As a general rule, the nascent phase of a bull market heralds a propitious window for share acquisition, while the waning moments of a bear market can unveil enticing valuations for those with long-term investment horizons.

Decoding Economic Prognostications

Economic barometers serve as invaluable harbingers of market vitality and warrant close scrutiny. Such indicators span the gamut from employment figures and GDP expansion to inflationary trends. A robust economy frequently engenders a thriving stock market, whereas an enfeebled economy may precipitate dwindling stock prices. Staying attuned to these markers empowers you to make well-informed decisions regarding share acquisition timings.

Peering Beneath the Surface: Delving into Corporate Performance

The Tale of Earnings Reports

Earnings reports, divulged on a quarterly basis, offer a treasure trove of information about a company’s fiscal health. Instances of positive earnings surprises, wherein a firm’s earnings surpass analysts’ forecasts, can trigger stock price escalations. On the flip side, negative earnings surprises could provoke stock price depreciation. By meticulously dissecting earnings reports and identifying patterns, you can gauge whether a company’s shares are on the precipice of growth.

The Enigmatic World of Financial Ratios

Financial ratios, such as price-to-earnings (P/E), price-to-sales (P/S), and price-to-book (P/B) ratios, can facilitate the evaluation of a company’s worth. Drawing comparisons between these ratios and industry benchmarks or historical precedents can provide insights into the relative over- or under-valuation of a stock. Capitalizing on shares when valuations are enticing can pave the way for more lucrative returns.

Capitalizing on Sector Rotation Phenomena

Investors frequently shift their allegiances among various sectors in response to economic climates or evolving market trends. By detecting sectors that exhibit burgeoning momentum or undervaluation, you can unearth enticing opportunities for share acquisition. For instance, should the technology sector outshine its counterparts, an investment in tech stocks may be judicious.

The Wisdom of Dollar-Cost Averaging

Dollar-cost averaging (DCA) is an investment tactic wherein you consistently allocate a predetermined sum at regular intervals, irrespective of prevailing market conditions. This approach circumvents the perilous endeavor of market timing and mitigates the risk of amassing shares at their zenith. Over an extended period, DCA can facilitate the cultivation of a formidable portfolio boasting a lower average expenditure per share.

A Concluding Word of Caution

While no infallible technique exists to pinpoint the optimal market entry point, a thorough comprehension of market cycles, a keen analysis of corporate performance, the identification of sector rotation possibilities, and the judicious implementation of dollar-cost averaging can bolster your efforts in determining the right time to buy company shares. By remaining well-informed and exercising discipline, you can augment your likelihood of reaping the rewards of a successful stock market venture. Remember, investing is an art that demands patience and continuous learning; your journey will be fraught with challenges, but the potential for long-term growth is well worth the effort.

Google News | Telegram