The revolution underway in India’s diamond industry

Chintan Suhagiya is only 26, but already has seven years experience working in India’s diamond industry.

Starting out, he ferried diamonds around his company, based in the world’s diamond polishing capital, Surat in western India.But over the years he learnt how to inspect diamonds and now he grades their quality, using specialist equipment.His career has been transformed by a seismic shift in the diamond industry. Until two years ago, all the diamonds he inspected were natural – pulled from the ground at diamond mines.Now he works with diamonds grown in special machines, part of the industry that barely existed 10 years ago but, thanks to improved technology, has seen explosive growth.

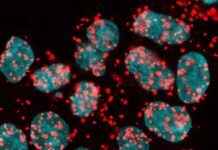

Lab-grown diamonds (LGDs) so closely resemble natural diamonds that even experts have to look closely.”No naked eye can tell the difference between natural and lab-grown diamonds,” says Mr Suhagiya.

“The natural diamonds and lab-grown diamonds are so similar that once, even after a lab test there was a confusion about the origin of a diamond. The diamond had to be tested twice to make sure that it was a lab-grown,” he says.

Natural diamonds are formed at great heat and pressure deep underground and, since the 1950s, scientists have been trying to recreate that process above ground – resulting in two techniques.

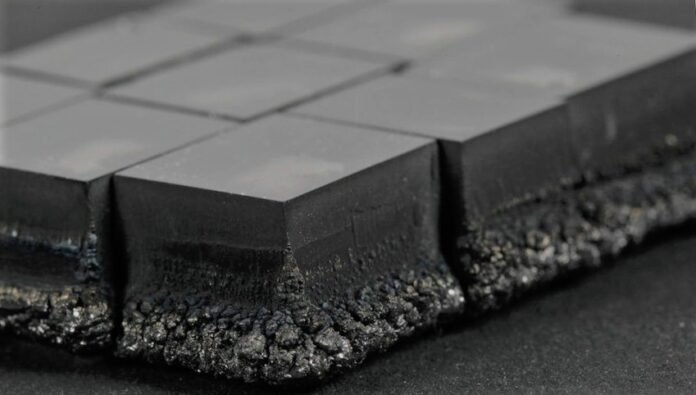

The High Pressure High Temperature (HPHT) system is where a diamond seed is surrounded by pure graphite (a type of carbon) and exposed to temperatures of about 1,500C and pressurised to approximately 1.5 million pounds per square inch in a chamber.

The second process is called Chemical Vapour Deposition (CVD) and involves putting the seed in a sealed chamber filled with carbon-rich gas and heating to around 800C. The gas sticks to the seed, building up a diamond atom by atom.

While those techniques emerged in the late 20th Century, it’s only in the last 10 years that the process has been refined so that lab-grown diamonds can be made at the right price and quality to be sold as jewellery.

“In the beginning, it was harder, because there were very few machines and very few scientists able to do it… over the last seven years, as more expertise became available in the market, we’ve seen really big growth,” says Olya Linde, a Zurich-based partner with Bain and Company’s Natural Resources practice.

Ms Linde says that since the early 2000s the cost of producing lab-grown diamonds has halved every four years.

These days, a one carat diamond – a popular size and common in engagement rings – made in a lab would be around 20% cheaper than its naturally-formed equivalent.

Those falling costs have attracted entrepreneurs.

Snehal Dungarni is the chief executive of Bhanderi Lab Grown Diamonds, which he started in 2013. It uses the CVD process to make diamonds.

“We are able to monitor the growth of the diamond, atom by atom, at the highest degree of purity.

“Comparatively they are cost and time-effective and save mining and extraction costs – making them human and environmentally kind,” he says.

India has long played a key role in the diamond industry – it’s estimated that nine out of 10 of the world’s diamonds are polished in Surat.

Now the government wants India to become a key player in the lab-grown diamond business.

The nation already produces around three million lab-grown diamonds a year, accounting for 15% of global production, according to the Ministry of Commerce and Industry. China is the other big producer, with a similar market share.

In January, in an effort to boost the sector further, the Indian government abolished a 5% tax on imported diamond seeds and announced funding to help India develop its own diamond seed production.

“As global prosperity increases, the demand for diamonds will increase,” says Vipul Bansal, joint secretary at the Ministry of Commerce.

With 30 years in the traditional diamond industry, Hari Krishna Exports is India’s leading producer of cut and polished diamonds.

But this year director Ghanshyambhai Dholakia founded a lab-grown diamond business.

“In the next three to four years, we will see a massive demand and growth in lab-made diamonds,” he predicts.

But will the new business take market share from his traditional diamond business?

“Both natural and lab-made diamonds cater to different consumer segments. And demand exists in both segments,” says Mr Dholakia.

“LGD has opened a new consumer market – middle class in India – who have money and will be able to afford a lab-grown diamond,” he says.

It might take some time for that market to take off in India, though. Most LGDs made in India are exported to the US.

“The Indian market is still not ready, so we as council are promoting exhibitions and events to create a place for LGDs. In three to four years India will be ready,” says Shashikant Dalichand Shah, chairman of the Lab Grown Diamond and Jewellery Promotion Council.

Google News | Telegram